Rumored Buzz on Summitpath Llp

Rumored Buzz on Summitpath Llp

Blog Article

Little Known Questions About Summitpath Llp.

Table of ContentsThe Ultimate Guide To Summitpath LlpThe smart Trick of Summitpath Llp That Nobody is Talking AboutSummitpath Llp Can Be Fun For EveryoneOur Summitpath Llp Statements

Most recently, released the CAS 2.0 Practice Development Coaching Program. https://myanimelist.net/profile/summitp4th. The multi-step coaching program consists of: Pre-coaching alignment Interactive team sessions Roundtable conversations Embellished training Action-oriented mini intends Firms looking to increase into consultatory solutions can also turn to Thomson Reuters Practice Ahead. This market-proven methodology offers content, tools, and guidance for companies thinking about advisory servicesWhile the adjustments have actually unlocked a number of development opportunities, they have also resulted in difficulties and problems that today's companies need to have on their radars., firms must have the capacity to promptly and efficiently conduct tax obligation study and enhance tax coverage effectiveness.

Furthermore, the new disclosures might bring about a boost in non-GAAP actions, traditionally an issue that is highly inspected by the SEC." Accounting professionals have a whole lot on their plate from regulatory changes, to reimagined business designs, to a rise in customer assumptions. Equaling it all can be tough, but it does not need to be.

Not known Incorrect Statements About Summitpath Llp

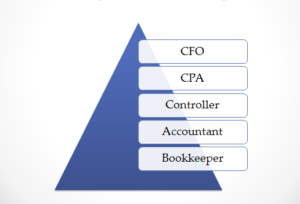

Below, we define 4 CPA specializeds: taxes, management accounting, economic coverage, and forensic audit. CPAs specializing in taxation aid their clients prepare and submit income tax return, lower their tax obligation worry, and stay clear of making errors that can lead to pricey fines. All CPAs need some knowledge of tax regulation, but concentrating on taxes implies this will be the emphasis of your job.

Forensic accountants normally begin as general accounting professionals and relocate into forensic accountancy duties with time. They need strong analytical, investigative, business, and technical bookkeeping abilities. CPAs who concentrate on forensic accountancy can occasionally relocate up into monitoring accounting. CPAs need a minimum of a bachelor's degree in accountancy or a similar area, and they must finish 150 credit score hours, including accountancy and organization courses.

No states need a graduate level in accounting., auditing, and taxation.

And I liked that there are great deals of different job options which I would not be unemployed after graduation. Bookkeeping likewise makes functional feeling to me; it's not simply academic. I such as that the debits always need to amount to the credit ratings, and the equilibrium sheet has to stabilize. The certified public accountant is an important credential to me, and I still get continuing education credit reports every year to stay on top of our state needs.

Some Ideas on Summitpath Llp You Need To Know

As a freelance consultant, I still use all the fundamental foundation of bookkeeping that I learned in college, seeking my CPA, and operating in public accounting. Among the things I actually like regarding audit is that there are various jobs readily available. I decided that I wanted to begin my career in public audit in order to learn a great deal in a short duration of time and be revealed to different sorts of customers and various locations of bookkeeping.

"There are some work environments that don't intend to think about somebody for a bookkeeping function that is not a CERTIFIED PUBLIC ACCOUNTANT." Jeanie Gorlovsky-Schepp, CERTIFIED PUBLIC ACCOUNTANT A CPA is a very beneficial credential, and I intended to place myself well in the market for numerous tasks - tax preparation services. I determined in university as an accountancy major that I wanted to attempt to get my CPA as soon as I could

I have actually fulfilled lots of fantastic accountants that do not have a CPA, but in my experience, having the credential truly helps to promote your experience and makes a distinction in your compensation and job options. There are some workplaces that do not wish to think about someone for an accounting role that is not a CPA.

How Summitpath Llp can Save You Time, Stress, and Money.

I actually took pleasure in working with different kinds of tasks with different clients. I discovered a lot from each of my coworkers and customers. I collaborated with numerous different not-for-profit companies and located that I want mission-driven organizations. In 2021, I determined to take the following action in my bookkeeping occupation trip, and click over here now I am currently a self-employed accounting specialist and company expert.

It continues to be a development area for me. One vital high quality in being an effective CPA is really respecting your customers and their companies. I love collaborating with not-for-profit customers for that very factor I seem like I'm truly contributing to their objective by assisting them have excellent monetary details on which to make smart organization choices.

Report this page